Overview

Image may be NSFW.Clik here to view.

The 2017 Tax Cuts and Jobs Act made deep cuts to the personal income, estate, and corporate income taxes that were costly and heavily skewed toward the very wealthy.1 The law’s temporary doubling of the estate tax exemption—the threshold at which estates are subject to tax—expires at the end of 2025, along with the personal income tax changes. The law’s changes to the estate tax were projected to reduce federal revenues by $83 billion from 2018 to 2027 and slashed the number of estates subject to tax by more than half.2 If these changes are made permanent, the nonpartisan Congressional Budget Office estimates that “primary deficits over the 2025–2034 period would be $167 billion larger” than they would under current law.3

The United States has taxed the transfer of property at death for nearly the entire history of our nation, beginning with the Stamp Act of 1797.4 The current tax, which is levied on the transfer of wealth from an estate rather than on the recipients of that value, was created by the Revenue Act of 1916.5 Throughout its history, the federal estate tax has served as both an important source of revenue and as a tool for stemming the concentration of wealth and the political influence resulting from it.6

But policy changes over the past quarter-century have greatly reduced its role as a revenue source and its utility as a tool for addressing inequality. Because it applies only to the value of an estate above a fixed exemption level, only a tiny fraction of the largest estates—those owned by the wealthiest 0.2 percent of decedents expected to die in 2023—were projected to be taxable.7 Moreover, because the exemptions in the current tax are so large, income received by heirs in the form of inheritances is taxed at an average rate of just 2 percent.8

In what observers have called “the great wealth transfer,” baby boomers will leave an estimated $80 trillion in assets to their children and other heirs over the next two decades.9 The magnitude of these impending transfers gives new urgency to the upcoming policy debate. To inform this debate, this policy brief reviews recent changes to the estate tax against the backdrop of rising inequality, looks at who does and doesn’t pay the tax, and offers options for strengthening the tax that would improve its efficiency and make the tax code as a whole more equitable.

Wealth inequality has increased in the United States

Image may be NSFW.Clik here to view.

The past 50 years have been marked by widening disparities in income and wealth. Wealth—the share of assets held by a household at a given point in time—is even more concentrated than income.10 In 2019, for example, a Congressional Budget Office study reported that families in the highest U.S. income quintile received 56 percent of family income but held 70 percent of family wealth.11

After slowing briefly in the wake of the decline associated with the short but sharp downturn in financial markets triggered by the COVID-19 pandemic, the share of wealth held by wealthiest U.S. households has once again begun to rise.12 In the first quarter of 2024, the wealthiest 0.1 percent of households held a full 13.6 percent of household wealth.13 (See Figure 1.) Overall, inheritances account for roughly 40 percent of all wealth in the United States.14

Figure 1

Clik here to view.

Inequalities of wealth marked by extreme growth at the top of the wealth distribution are a global phenomenon, yet wealth inequality in the United States far outstrips that of other economically advanced nations. At the end of the past decade, the share of wealth held by the wealthiest 10 percent of households in the United States far surpassed that in other nations that are members of the Organisation for Economic Co-operation and Development.15 (See Figure 2.)

Figure 2

Clik here to view.

Within the United States, wealth disparities have widened substantially, with the share of wealth held by the wealthiest 1 percent of households rising to 30.4 percent at the beginning of 2024 from 22.8 percent at the end of 1989.16 (See Figure 3.)

Figure 3

Clik here to view.

Inheritances have helped to perpetuate inequality in the United States across generations and have important implications for economic opportunity and mobility. While intergenerational transfers are widespread, most inheritances are relatively small—more than half are less than $50,000—and account for a relatively small share of bequeathed assets.17 By contrast, large transfers of $1 million or more account for about 2 percent of total estates but make up 40 percent of dollars transferred.

Researchers find that nearly a third of the correlation between parent and child incomes is attributable to inheritances, as is more than half of the correlation between parent and child wealth.18 One study based on two decades of data from the Federal Reserve Board’s Survey of Consumer Finances finds that recipients of inheritances and intergenerational gifts are more likely to be White, have higher median incomes, and are more likely to have a college-educated parent than the population at large.19 (See Table 1.)

Table 1

Clik here to view.

Using the same data, the authors confirmed the role of inheritances and intergenerational gifts in wealth concentration by estimating the share of wealth directly accounted for by these transfers, finding that they accounted for one-quarter to one-half of transfer recipients’ wealth.20

The tax treatment of inheritances has helped to perpetuate inequality across generations. Take, for example, a wealthy entrepreneur’s child, who inherits tens of millions of dollars. The heir pays no taxes on the amount that they receive upon the death of their parent.21 By contrast, the child of lower- or middle-income parents inherits nothing and lives off the wage and salary income they earn to support themselves—and pays income and payroll taxes on all that they receive.

While the estate and gift taxes partially address this disparity by reducing the size of the very largest estates by the amount of tax paid, inherited income is taxed at less than one-seventh the rate of average tax on income from work and savings due to multiple tax preferences for investment income and inherited wealth.22

How does the federal estate tax work?

Image may be NSFW.Clik here to view.

The federal estate tax applies to assets passed on at death that exceed a fixed exemption level. Taxes owed are paid out of the estate, and heirs pay neither income nor payroll taxes on amounts that they receive. Married decedents can transfer any unused portion of their exemption to a surviving spouse, effectively doubling the size of the exemption for a married couple.23 The tax applies to everything of value from stocks and bonds to art and jewelry to real estate.

The estate tax is often considered in tandem with the gift tax, which applies to transfers of wealth by a donor during her or his lifetime to an individual above an annual exclusion amount ($18,000 in 2024) that exceed the estate tax exemption over the lifetime of the donor.24 Transfers of assets to spouses and charities are not taxed, and special provisions apply to inheritances consisting of closely held family businesses.25

The estate tax is overwhelmingly paid by the estates bequeathed by high-income earners. The Tax Policy Center estimates that in 2023, the top 10 percent of income-earners paid 90 percent of the tax and the top 0.1 percent—140 taxable estates—paid 29 percent of all estate taxes paid.26 (See Figure 4.)

Figure 4

Clik here to view.

Evidence suggests that the estate tax has minimal impact on growth and savings

There is minimal research on the impact of wealth-transfer taxes on economic growth largely due to data limitations and the methodological difficulties of associating behavioral decisions on investment and savings with an event that may occur far in the future—that is, death.27 The evidence that does exist suggests that taxes levied on wealth at death have minimal impact on the savings and employment decisions of wealthy individuals, those whose estates are subject to tax.28

Observers posit that the lack of a negative response reflects the mixed motivations driving the wealthy to accumulate wealth. According to former U.S. Treasury Assistant Secretary for Tax Policy Lily Batchelder, “a lot of the reason why the wealthy save is to be wealthy while they are alive, which wealth transfer taxes do not affect.”29 Evidence suggests that inheritance taxes have little impact on the rate of savings of people who leave large estates, but that because they reduce the amount of inheritance an heir has to live on, they do encourage work and savings among wealthy heirs, which contributes to economic growth.30 Research also suggests that wealth-transfer taxes also improve businesses’ productivity largely because firms run by heirs tend to perform poorly relative to their peers.31

Lastly, the structure of the estate and gift taxes worsens the so-called lock-in effects of the broader set of preferences for capital gains. The deferral of tax until an asset is sold rewards investors for holding onto appreciated, but poorly performing, assets which can distort capital allocation decisions.32 A shift to a system that taxes capital gains as they are accrued—or, alternatively, at death—would minimize or eliminate this effect and promote greater economic growth and efficiency by allowing capital to flow to more productive and higher-performing assets.

Recent changes have significantly eroded the estate tax

Estate tax rate cuts and increases in the amount of an estate that is exempt from tax have significantly eroded the number of estates subject to tax and the revenues raised by it over the past 25 years. The 2001 tax cuts enacted during the George W. Bush administration reduced the estate tax rate from 55 percent in 2001 to 45 percent in 2007 through 2009 and increased the exemption from $675,000 in 2001 to $3.5 million in 2009. For one year only, the tax was eliminated in 2010.33 These changes expired in 2011 and would have returned both the rate and the exemption to pre-2001 levels.

But as part of negotiations over the extension of the Bush tax cuts, a divided U.S. Congress temporarily increased the exemption to $5 million and indexed it for inflation going forward, while reducing the tax rate to 35 percent in 2011 and 2012. In 2012, the exemption level was made permanent, and the rate increased to 40 percent.

The 2017 tax bill further slashed the estate tax, doubling the amount of assets that are exempt from taxation for the period 2018 to 2025. In 2024, the exemption is $13.61 million.34 Absent congressional action, the exemption will revert to the pre-2018 level, adjusted for inflation, beginning in 2026. Yet the increased exemption understates the extent to which the Tax Cuts and Jobs Act of 2017 reduced the estate tax because sophisticated tax-planning techniques allow taxpayers who have assets far in excess of the exemption levels to avoid the estate tax.35

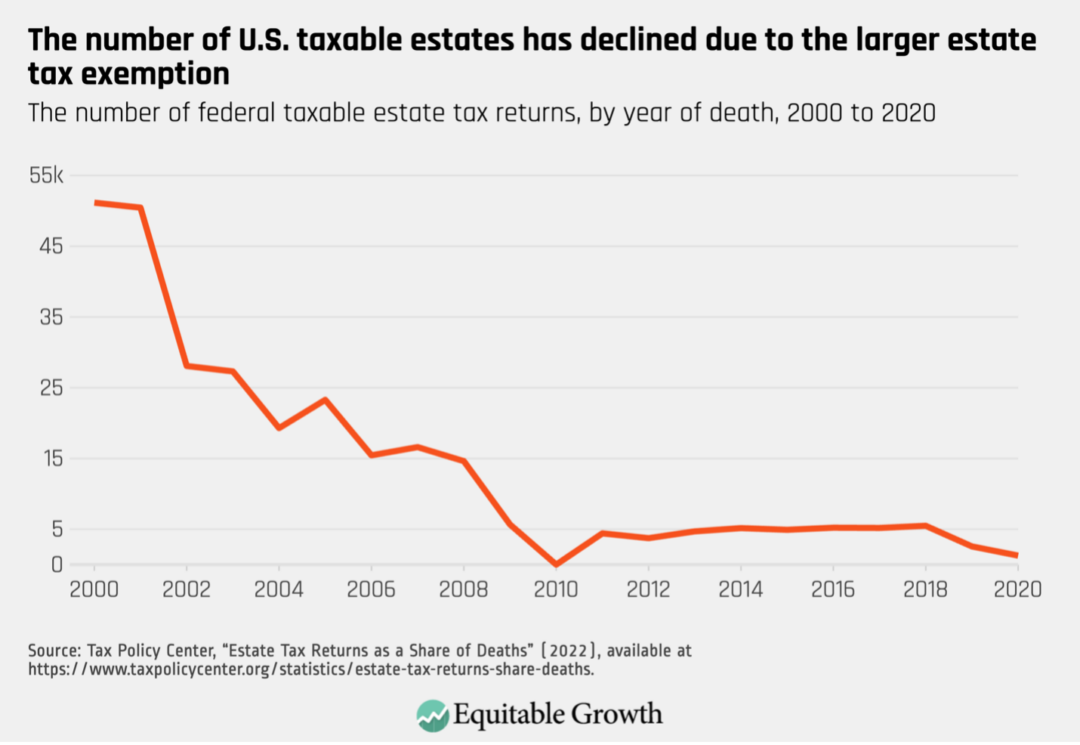

As a result of these changes, the number of estates subject to tax has declined substantially, both in absolute terms and as a percentage of tax. In 2020, there were 1,275 taxable estate tax returns, corresponding to just 0.04 percent of adult deaths in that year.36 By contrast, in 2001—the year before the changes made by that year’s tax bill took effect—50,456 taxable returns were filed, corresponding to 2.14 percent of adult deaths in that year. (See Figure 5.)

Figure 5

Clik here to view.

The decline in the number of taxable estates has resulted in a parallel drop in revenue. Estate tax liability fell as a percentage of Gross Domestic Product from 0.23 percent in 2001 to 0.04 percent in 2020.37

The wealthy use multiple tax breaks to shelter their estates from tax

The erosion of the estate tax compounds the impact of the relatively light taxation of income from wealth, compared to that on income from work. Income from financial assets that make up the majority of taxable estates is subject to preferential tax rates for capital gains and qualified dividends.38 Business assets, another significant component of taxable estates, often qualify for a myriad of tax breaks that result in a lower tax rate than that on income from work.39

In addition to these preferences, a number of specific policies provide special treatment for assets that ultimately constitute an estate. One of the largest of these tax breaks is the so-called stepped-up basis, which adjusts the value of an asset to its fair market value as of the time of the previous owner’s death and allows the pre-death increase to permanently escape income taxation. This benefit is significant since an estimated 34 percent to 44 percent of the value of all taxable estates consists of unrealized, and thus untaxed, capital gains—a figure that rises to an estimated 55 percent for the very largest estates.40

The step-up in basis allows these gains to permanently escape the income tax. Recipients of appreciated assets gifted during a donor’s lifetime are eligible for carryover basis, meaning that those gains are exempt from tax until sold by the recipient of the gift.

Other tax avoidance strategies include provisions that allow the gaming of asset valuation rules and the use of trusts, such as grantor trusts and grantor-retained annuity trusts, to deflate the value of transferred assets and thus reduce estate tax liability. This gaming amplifies the impact of changes to the rates or exemption amounts.

A comparison of information reported on federal estate tax returns to that from Forbes magazine’s listing of the 400 wealthiest Americans by IRS researchers finds that “the values reported for tax purposes are approximately half those estimated by Forbes.” The three co-authors of that research note that “tax values and Forbes values were in closest agreement when valuation issues were relatively objective … but much further apart when the portfolio was dominated by assets, for which valuation required a greater degree of subjectivity or were difficult to observe.”41

Preferential taxation continues when wealth is transferred to the next generation. Heirs pay no income or payroll taxes on amounts they inherit, leaving the average tax rate on inherited income far below that on income from work.42 Heirs can also defer taxes due on gains earned after the date they inherit an asset indefinitely and even borrow against the value of those assets before passing them on to succeeding generations as part of a “borrow and die” strategy.43

Policymakers can reform the estate tax in 2025 to make the federal tax system more effective and more equitable

Image may be NSFW.Clik here to view.

The expiration of the 2017 tax changes at the end of 2025 provide policymakers with the opportunity to revisit the estate tax within the context of broad-based tax reforms. Lawmakers also could consider more fundamental reforms that have allowed massive fortunes to accumulate and be passed on to future generations with minimal or no taxation.

Let’s consider these options in turn.

Options for reform within the current framework

Changes that would strengthen the ability of the federal tax system to address inequality within the current framework, while also generating revenue that could be invested to promote more equitable economic growth, include:

- Allowing the 2017 changes to sunset: The 2017 tax bill doubled the estate tax exemption, raising it from $5.6 million in 2018 to $11.2 million and adjusted it for inflation thereafter.44 Allowing the increase to sunset at the end of 2025 would return the exemption to its pre-2018 level, adjusted for inflation, and would leave an estimated 99.7 percent of all estates untaxed.45

- Rolling back the exemption and rate to 2009 levels:Returning the estate tax exemption to its 2009 level of $3.5 million and rate of 45 percent would raise significant added revenue—an estimated $244 billion from 2026 through 2032—while still leaving 99.2 percent of estates untaxed.46

- Raising the rate: Raising the estate tax rate would strengthen the tax and increase the progressivity of the tax. A tiered rate structure, with higher rates on extremely large estates, would address the most extreme inequalities while raising revenues to support broad-based economic growth.

These reforms could be combined with more modest changes limiting opportunities for avoidance and abuse by cracking down on strategies used by the wealthy and their tax planners, such as the abuse of valuation rules to reduce taxes owed, the use of trust instruments to avoid taxes owed upon transfer, and by imposing stronger reporting requirements on offshore trusts.47

Structural reforms that would reduce inequality and advance growth

Structural reforms to the estate tax could include alternatives, such as reducing or ending the tax preferences for income from wealth, compared to income from work, or moving to a system that treats inheritances as income to an heir rather than as a liability of an estate. These approaches would help reduce inequality and improve the progressivity of the tax code while raising revenues to invest in future economic growth.48 Four options for structural reform are considered below.

Replacing the estate tax with an inheritance tax

The current estate tax is paid out of transferred wealth, regardless of the economic circumstances of the heirs who receive that wealth. NYU School of Law professor and former Treasury Department official Lily Batchelder and others have proposed repealing the current tax and replacing it with an inheritance tax that would be levied based on the amount that heirs of large inheritances receive above a lifetime exemption.49 Such a tax could be structured to more equitably tax the transfer of wealth by imposing a higher tax on the recipients of large inheritances relative to those who receive less.

Replacing the estate tax with an inheritance tax also would address an often-heard critique of estate taxes—that they penalize frugal or successful individuals by shifting the tax to those who receive wealth through no effort of their own. A well-designed inheritance tax would also be easier to administer since it would only be imposed on amounts transferred net of gifts to tax-exempt entities and would promote economic growth by limiting opportunities for unproductive tax planning.50

The Tax Policy Center estimated that replacing the current estate tax with an inheritance tax that treats bequests as income to an heir subject to payroll and income taxes beginning in 2022 would have generated nearly $1 trillion in additional revenue from 2022 to 2031.51

Repealing stepped-up basis

Eliminating the stepped-up basis would greatly strengthen the tax code and could be done on a stand-alone basis or in combination with other reforms. Nearly all the revenue raised by repeal of stepped-up basis would be paid by the very wealthy. Estimates suggest that 99 percent would be paid by the top 1 percent of earners and 80 percent would be paid by the top 0.1 percent.52

President Joe Biden proposed a repeal of stepped-up basis on assets with a $5 million exemption as part of his proposed fiscal year 2025 budget.53 The U.S. Department of the Treasury estimates that stepped-up basis will result in a loss of $510 billion in potential revenue from 2024 to 2033.54

Treating unrealized capital gains as taxable income

While not technically a reform of the estate tax, treating unrealized capital gains as taxable income would end a tax preference that provides a preference for income from wealth relative to that from work. Leveling the playing field between the taxation of income from wealth and income from work would improve the equity of the tax code because the wealthy receive a much larger share of the income from wealth.

Treating unrealized capital gains as taxable income also would encourage economic growth by ending the lock-in effect that limits the reallocation of capital to its most productive uses. Proposals by President Biden in his FY2025 budget and proposed legislation by Senate Finance Committee Chair Ron Wyden (D-OR) would tax the gains on appreciated assets on an annual basis.55

Taxing capital gains at death

Alternatively, accrued capital gains could be taxed at death by treating death as a realization event for tax purposes. Under such an approach, the gains would be taxed as if the decedent sold the asset at death and the value of assets received by heirs would be the market value as of the decedent’s death. The value of the estate for tax purposes would be reduced by the amount of income tax paid on capital gains.

The U.S. Congress’ Joint Committee on Taxation estimates that the exclusion of capital gains at death costs $40 billion a year in lost tax revenue.56

Conclusion

Image may be NSFW.Clik here to view.

Strengthening the federal estate tax is an effective tool for narrowing vast inequalities of wealth and income and for raising revenues that can be invested to advance a pro-growth economic policy agenda. The expiration of the 2017 tax bill’s changes to the estate tax in 2025 provide policymakers with an opportunity to expand the number of estates and amount of wealth subject to the tax, while still leaving the vast number of estates untaxed, as well as to enact reforms that would limit opportunities for abuse and tax avoidance.

About the author

Image may be NSFW.Clik here to view.

Jean Ross is an economist and tax policy analyst and the principal of Jean Ross Policy | Strategy. She holds a M.C.P from the University of California, Berkeley in regional economics and economic development.

Acknowledgments

Image may be NSFW.Clik here to view.

The author wishes to thank Samantha Jacoby, Mike Kaecher, Chuck Marr, and David Mitchell for their thoughtful comments.

The post Allowing the 2017 estate tax changes to expire will reduce U.S. inequality and promote economic growth and opportunity appeared first on Equitable Growth.